Owning a home in today’s market is no small feat. If you’re at the point where you’re ready to buy a second house as an investment property, nice work! It’s an exciting step on your way to financial freedom and stress-free retirement.

Competition, cost and choice can make it difficult to know which property is the best investment. Not to mention building reports, auctions and rising housing prices that add more layers of complexity. But, when you’re ready to start looking, help is at hand.

Performing the following due diligence will help you choose a property that gives you a great return on your hard-earned investment – without causing too many headaches.

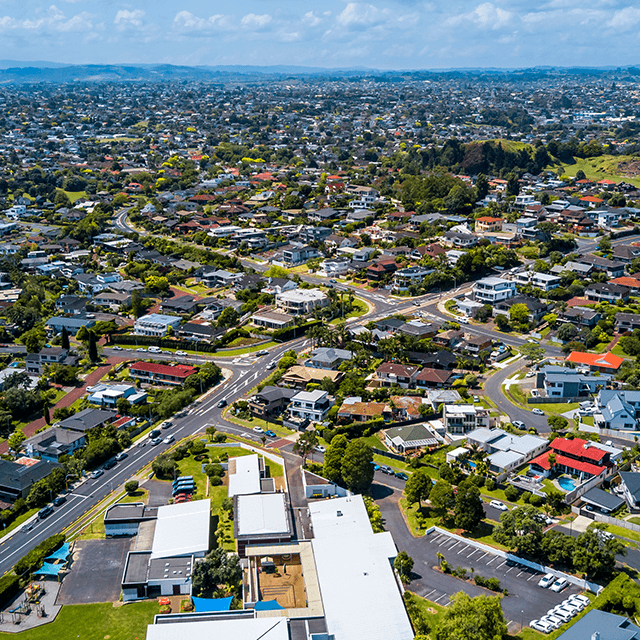

1. Good loca tion, more rental potential

The last thing you want is to be stuck with a rental property in a stagnant area or where the population is on the decline. You’ve heard the saying, ‘Buy the worst house on the best street’, but there’s a bit more to it, especially when investing.

In towns surrounding New Zealand’s main cities, with growing populations and community developments underway, house prices are often lower than in the city. These locations signal solid investment opportunities with long-term gains.

Check to see if crime rates are low, there are good schools and well-kept parks nearby and council rates aren’t too high. This will mean a much larger pool of quality tenants. Remember, you’ll always be able to charge more the closer your rental property is to amenities and the city.

Lastly, compare the buying price against the rental income potential for each property you look at.

2. Low-cost homes mean long-term savings

If you already own your first home, you’ll be well aware of the ongoing maintenance, not to mention those pesky unexpected costs. These usually amount to approximately 1% of the property value annually. So the more expensive the house, the greater the costs. If you want to save your money and increase equity as quickly as possible, choose a house at a reasonable price in a location with low council rates.

3. Sturdy builds easy to maintain

While it can be tempting to grab a doer-upper at a bargain price, for first-time investors it can be a quick way to end up paying more.

Ask yourself this question – are you cut out for DIY when your tenants call? If not, hiring contractors who do quality work isn’t cheap and can cut deep into your profits.

Make things easier in the long run and find a house that’s built well and easy to maintain. And don’t rule out well-priced new builds, as they may save you money down the track.

4. Good margins and ROI

When choosing a rental property, it’s important to look for one that meets your personal investment goals. New Zealand’s property market is a good long-term investment that can give you great returns, but usually only after you sell.

In general, the majority of rental income goes on ongoing costs such as mortgage repayments, insurance and maintenance.

Calculate your potential annual profit and think about when you would need to liquidate. If you sell within 10 years, you’ll also need to factor in income tax.

5. Housing developments are a good option

Housing NZ has forecasted that Auckland alone will need 400,000 new homes over the next 30 years to keep up with demand. Now that developers have been given the green light, new housing plans will be popping up at higher rates than ever before all over the country.

Buying into a future development means only paying a 10% deposit on the fixed house price before the house is built. Once the house is completed, its value has likely increased significantly. That means you benefit from low maintenance costs – and a great return on investment.

Good investment decisions will pay off

The options available for first-time property investors can feel like a minefield – especially with such a huge financial decision. Choosing the right one for your needs isn’t straightforward and you’ll need to weigh the pros and cons for each property. It comes down to what you value most – and what your long-term goals are.

If you’re looking to purchase an investment property, but aren’t sure what’s right for you, contact the team at Global Finance today – we’ll help get the ball rolling.

**These are general guidelines and are by no means a reflection of bank or lending policies