Blog

From first-home to property portfolio

Global Finance help Rodrigues family hit property goals When Global Finance told Brian Rodrigues he could have his home loan paid off in half the expected time, he was cautiously excited. When his last mortgage repayment came out after only 9 years and 3 months – he...

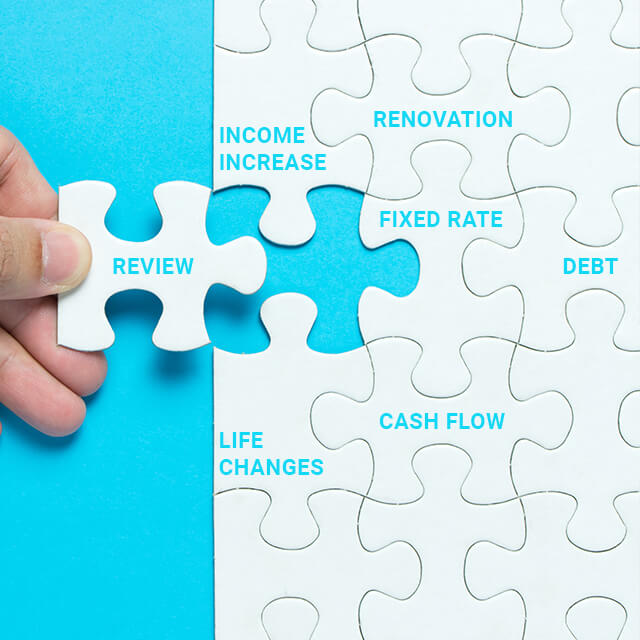

Is it time to review your home loan?

Making your home loan work for you When you first take on a mortgage, there’s a lot of thought involved. You go over your budget with a fine-tooth comb, working out how much you can afford to pay every month. You shop around for the best deals and interest rates or...

7 tips to start your property investment journey

In New Zealand, property is one of the most common forms of investment, and it’s not hard to see why. Not only is it tangible and relatively easy to understand, but investing in property comes with two potentially lucrative forms of income – rent and capital gains....

Key steps to taking out life insurance

Most of us secretly hope that we’ll make it to the ripe old age of 100, but we also know that’s not always the case. If you were to fall terminally ill or pass away unexpectedly, you’d want to make sure your family were in a financially safe position. Life insurance...

The ins and outs of refinancing your mortgage

Consider all the factors before making a decision You might ask, ‘Why would I swap my home loan for another one?’ The short answer is, because it can save you time and money. Let’s do it, you say, but there are several important factors you need to consider before...

Interest only mortgages – are they viable?

The pros and cons of going interest-only Most people with home loans will agree – the goal is to pay them off as quickly as possible. But for those considering interest-only mortgages, that might not be your top priority. Interest only home loans are designed with...

The mechanics of home loan pre-approval

Get it before you make an offer Once you’ve found your dream home, it can be hard to concentrate on anything else other than making an offer. But without pre-approval, that dream home is far less likely to become a reality. Making an offer on a home without first...

Should you consolidate your loans into your home loan?

Minimum payments, due dates, penalties, debt collectors – dealing with multiple debts can be complicated and overwhelming. You may have a mortgage, a car loan, credit cards to pay off, or other personal loans. It’s easy to feel as if you’ll always be struggling to pay...

Leveraging your home to buy commercial property

When you think of property investment, you probably imagine buying a house or unit and renting it to a nice young family or older couple. Most people don’t think about investing in commercial property. Buying commercial can be a worthwhile investment. In some ways,...

The benefits of trauma insurance

When you’ve just had a serious medical event, money is the last thing you want to think about. But day-to-day life doesn’t stop, even for heart attacks and cancer – you still need to find a way to pay your mortgage and utilities, not to mention all the day-to-day...

Do you need income protection insurance?

When you think of your assets, you probably picture tangible things like your house, car, boat or maybe some particularly valuable jewellery. But most people have one significant asset that isn’t so visible – earning power. Over your lifetime, your income will add up...

First time home buyers guide

What you need to know Looking for your first time home is equal parts exciting and nerve-wracking. The thought of getting into your own place is thrilling but spending your savings and taking on a huge mortgage is daunting. And that’s before you even start to think...

Protecting your biggest investment

Why first-home buyers need mortgage protection insurance Your first home is usually your first big investment. Whether you buy a relatively cheap do-up or a flashy apartment, you’re likely to be taking on hundreds of thousands in debt and entering into a +25-year...

Getting a construction loan for your dream home

Whether you’re looking for a way onto the property ladder or downsizing for retirement, you probably have a wish-list and a certain image in your mind when you think of the perfect home. But finding a property to match isn’t easy. Every home you view will have upsides...

Could a non-bank mortgage work for you?

When most people decide to take out a mortgage, their first stop is the bank. This may be because they trust a bank to manage such a significant loan, they believe that it offers the best options and rates, or they simply lack knowledge about other options. Banks do...

Understanding Life insurance premiums

Why premiums rise as you age – and what to do about it Life insurance can be frustrating. You pay your premiums for years even though you hopefully won’t need insurance for a long while, and when it does pay out, you’re not around to see the benefit. Worse, most life...

Remortgage NZ – Another look at your home loan

Making changes to suit your life When you sign the papers for your first mortgage, it feels as if you’re committing to your lender for the next thirty – or more – years. But that’s not always the case. While many people stay with their original lender for the term of...

Sorting things out after a marriage separation

What happens to your mortgage when you split? Separating from a partner or spouse is always painful. If you own joint property and have a mortgage, it can be even more complicated. Sorting out who will stay in the family home, who will pay the mortgage, and what will...